(This article was last updated on 11 November 2024.)

According to a 2024 survey, nearly 24% of employees admitted to claiming personal purchases as business expenses.

Expense reimbursement fraud is more common than you might think, quietly draining resources and eroding trust within teams.

Detecting and addressing it isn’t always straightforward, but if left unchecked, it can lead to significant financial losses and a culture of dishonesty.

In this guide, we’ll show you how to spot the warning signs, handle sensitive conversations with employees, and protect your business from future fraud.

What is Expense Reimbursement Fraud?

Expense reimbursement fraud happens when an employee intentionally submits false expense claims to gain extra money.

According to the Association of Certified Fraud Examiners (ACFE), there are four types of expense report fraud:

According to the Association of Certified Fraud Examiners (ACFE), there are four types of expense report fraud:

Mischaracterised expenses: Claiming personal expenses as business-related to get reimbursed.

Overstated or inflated expenses: Submitting real expenses but exaggerating the amounts.

Fictitious expenses: Reporting expenses that never happened and providing fake receipts.

Multiple reimbursements: Submitting the same expense more than once.

According to ACFE, this type of fraud accounts for 21% of fraud cases in small businesses and 11% in larger organisations.

How Do I Detect Expense Report Fraud?

Spotting expense report fraud requires careful attention.

Here are some steps to help you identify potential issues:

Here are some steps to help you identify potential issues:

Monitor company credit card charges: Look for suspicious charges that seem unrelated to work-related travel or business activities. This could be a sign that someone is fiddling with their expenses.

Scrutinise expenses during off-hours: Pay attention to expenses incurred during weekends, holidays, or outside normal working hours.

Review receipts and documentation: Check for missing receipts, altered documents, or inconsistent expense descriptions.

Compare expenses to company policy: Ensure all submitted expenses align with your company's official travel and expense policies.

Communicate with employees: Discuss travel plans and expected employee expenses before trips to set clear expectations.

According to ACFE, 43% of occupational fraud cases are detected through tips, with employees providing more than half of these reports.

This highlights the importance of fostering open communication and vigilance within your organisation to detect and address expense fraud.

How to Confront an Employee About Expense Reimbursement Fraud

Addressing expense fraud is sensitive, so it's important to handle it carefully.

Here's how you can approach it effectively:

Here's how you can approach it effectively:

1. Gather All the Facts First

Before you start the conversation, collect all the evidence related to the suspected fraud, like expense reports, receipts (and e-receipts), and relevant company expense policies.

This way, you'll have clear information to discuss.

Organise the discrepancies you've found.

Make sure you understand the company's expense policies thoroughly.

2. Consult with HR or Legal Counsel

It's wise to get advice from your HR department or legal counsel to ensure you're following the right procedures and respecting legal requirements.

Discuss the situation and potential outcomes.

Plan your meeting according to company guidelines.

3. Set Up a Private Meeting

Arrange a confidential meeting with the employee.

Let them know you want to discuss certain expense reports.

Choose a private and neutral location.

Schedule the meeting at a convenient time for both of you.

4. Explain Why This Matters

Start by highlighting the importance of accurate expense reporting and how discrepancies can affect the company.

Mention that you're aiming to resolve any misunderstandings.

Emphasise that accurate reporting is crucial for everyone's benefit.

5. Give the Employee a Chance to Explain

Allow the employee to share their side of the story.

Show them the specific expenses you're concerned about.

Ask open-ended questions to encourage them to talk.

Listen carefully without interrupting.

6. Stay Professional and Open-Minded

Throughout the conversation, keep a calm and non-accusatory tone.

Use neutral language.

Focus on the facts, not personal opinions.

Let them know you're seeking to understand, not to blame.

7. Decide on the Next Steps Together

After the discussion, determine what actions to take based on what you've learned.

If Fraud is Confirmed:

Follow your company's disciplinary procedures.

Consider options like repayment, official warnings, termination, or legal action, depending on how serious it is.

If No Fraud is Found:

Clear up any misunderstandings.

Provide additional training on expense policies.

Document the meeting for future reference.

Why is it Important to Confront an Employee About Expense Fraud Quickly?

According to ACFE, expense reimbursement fraud schemes have a median duration of 24 months before detection.

This extended period allows fraudulent activities to accumulate, leading to significant financial losses and potential legal complications.

Addressing expense fraud quickly is crucial for:

Addressing expense fraud quickly is crucial for:

Protecting your finances: By stopping fraudulent claims early, you prevent ongoing losses and safeguard your company's resources.

Ensuring legal compliance: Acting swiftly helps you stay in line with financial reporting laws and regulations, avoiding potential legal issues that could harm your business.

Maintaining company integrity: When you address fraud promptly, you promote honesty within your team and deter unethical behaviour. Your employees will see that you take integrity seriously.

Preventing bigger problems: Early intervention can stop minor issues from escalating into major fraud. By nipping problems in the bud, you save yourself from more significant losses and reputational damage down the line.

How Can ExpenseIn Help You Combat Expense Reimbursement Fraud?

Expense reimbursement fraud costs businesses millions every year. Since up to 75% of employees admit to stealing from an employer at least once, it's essential to have strong prevention measures.

ExpenseIn is an all-in-one automated expense management software with features like:

ExpenseIn is an all-in-one automated expense management software with features like:

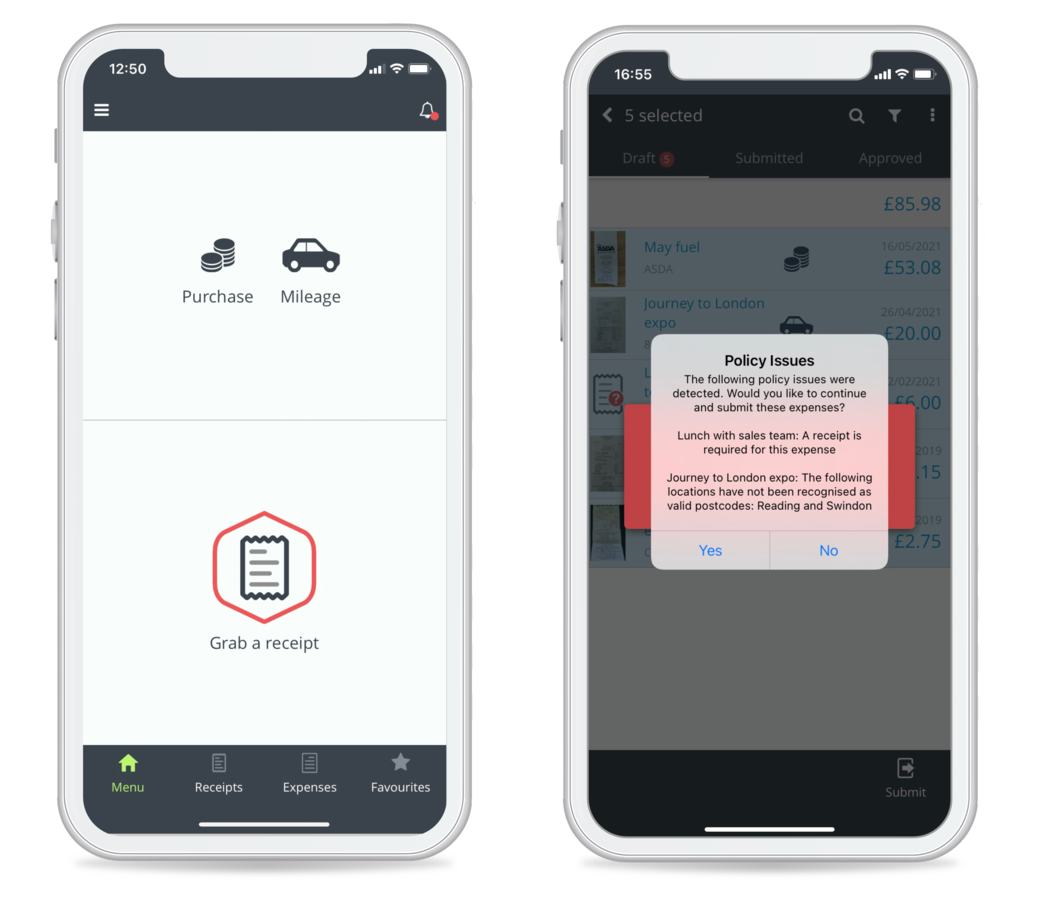

Automated policy checks: Makes sure expenses meet your company's rules in real-time.

Receipt verification: Uses AI-powered technology to check if receipts are genuine.

Audit policy acceptance: Boosts financial compliance by having employees acknowledge audit policies.

By using ExpenseIn, you reduce human error, lower the risk of fraud, and let your finance team focus on more important tasks.

Ready to safeguard your business from expense fraud? Book a free demo with ExpenseIn today.