2026 Irish Civil Service Mileage Rates

Managing mileage expenses can feel like a hassle for both employees and employers.

Knowing how the Irish civil service mileage rates work can help make the whole process easier.

All the updates and hand-picked resources

Managing mileage expenses can feel like a hassle for both employees and employers.

Knowing how the Irish civil service mileage rates work can help make the whole process easier.

Compare the top UK business expense cards for 2026 and discover which options give finance teams the best control, compliance, and real-time visibility over company spending.

The financial sector is jam-packed with acronyms and abbreviations. Here is a list of 25 frequently used finance acronyms and what they mean in alphabetical order.

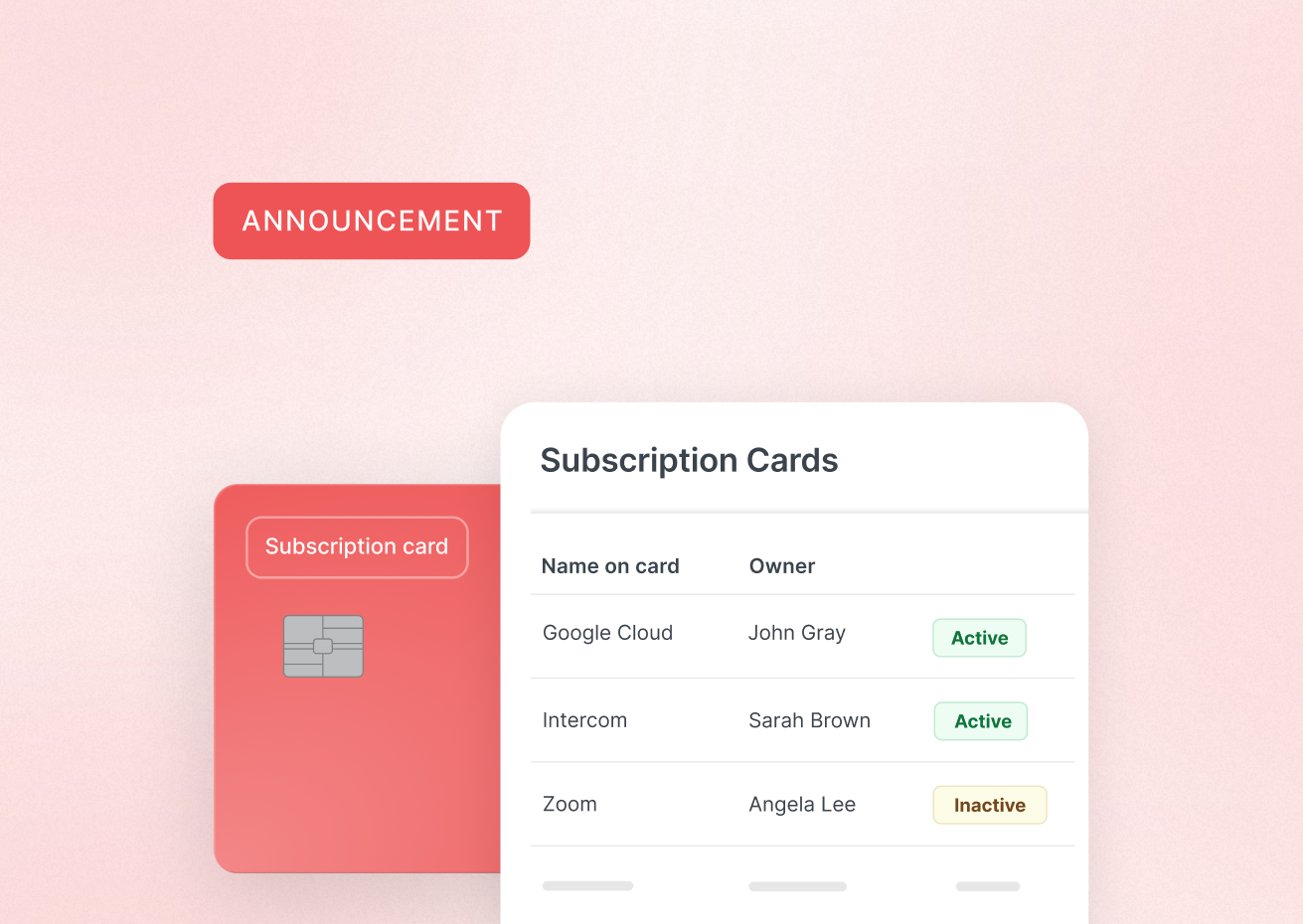

Recurring costs often run on autopilot. The ExpenseIn Subscription Card helps finance teams manage supplier and subscription spend in one place, with less manual work.

ExpenseIn has been awarded two Gartner Digital Markets badges for 2026: Best Value and Best Ease of Use, based on verified customer reviews.

Feeling overwhelmed by the fiscal year end in the UK? Our guide breaks down all the key dates and offers actionable tips to navigate tax season stress-free.

Discover the best expense tracking software for UK finance teams in 2026 – with key features, comparisons, and how to choose the right fit.

As digital wallets become the default way employees pay, finance teams face new risks and opportunities. Here’s how to manage wallets with control, security, and visibility.

Explore ExpenseIn’s 2025 Wrapped: key milestones, product launches, security upgrades, and how we helped finance teams work smarter this year.

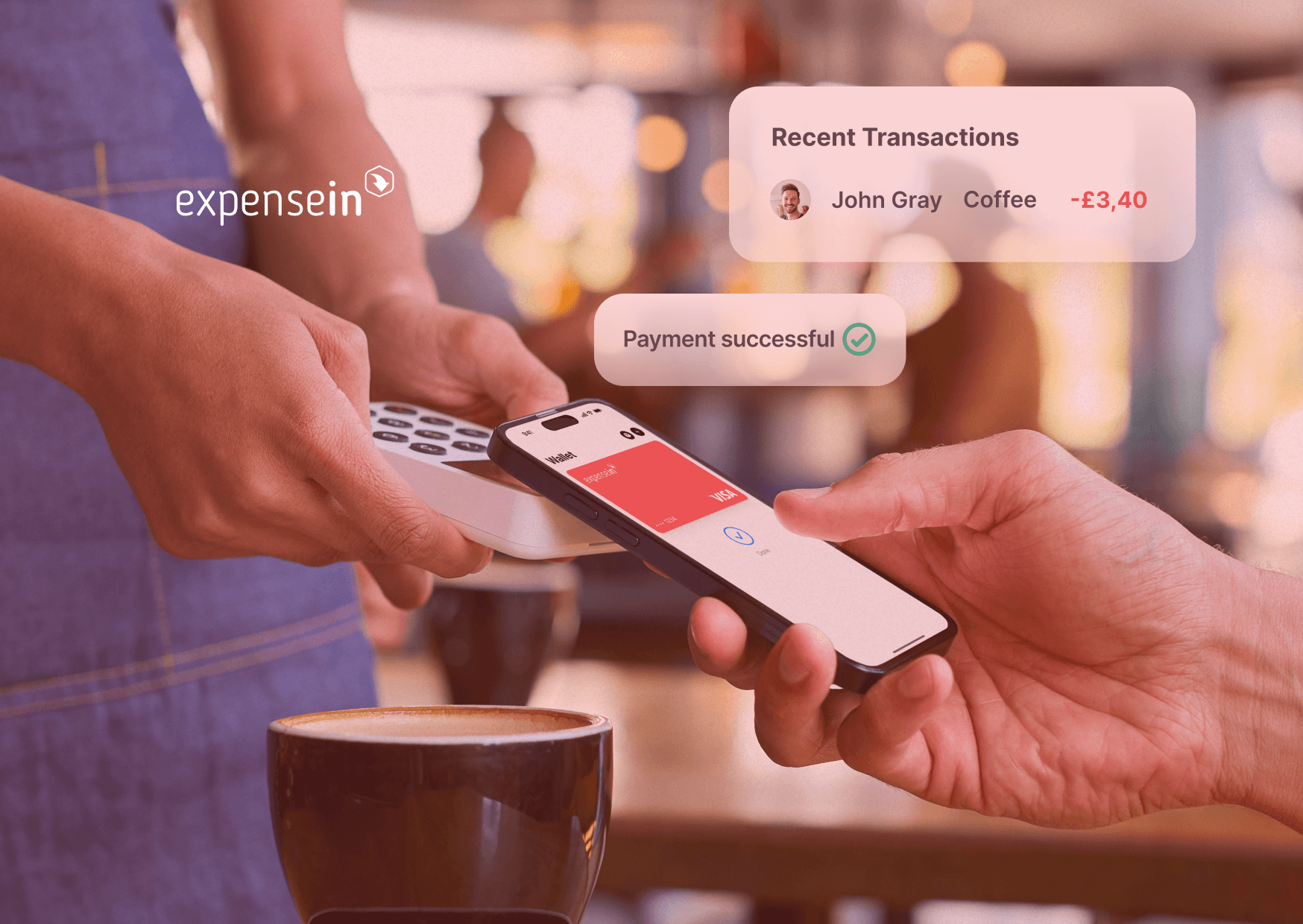

ExpenseIn Cards now support mobile wallets. Enable fast, secure tap-to-pay spending with Apple Pay and Google Pay, plus full visibility and control for finance.