Virtual business cards

Issue instant virtual cards your team can use anywhere. Faster, safer and more flexible than physical cards, with nothing to lose, replace or wait for.

Control company spend from the start

Live in seconds

No waiting. Virtual cards are ready when you need them.

Built-in policy rules

Set granular limits, block categories, and auto-expire cards.

Reusable by design

Reactivate dormant cards for new projects. No reissuing.

Built into your workflow

Cards, expenses, approvals, and reporting in one tool.

Trusted by many happy customers

Virtual cards for every employee, team, and use case

Department budgets

Give Marketing, HR, or IT pre-approved spend with built-in caps.

Event expenses

Issue a virtual card for a conference or training day.

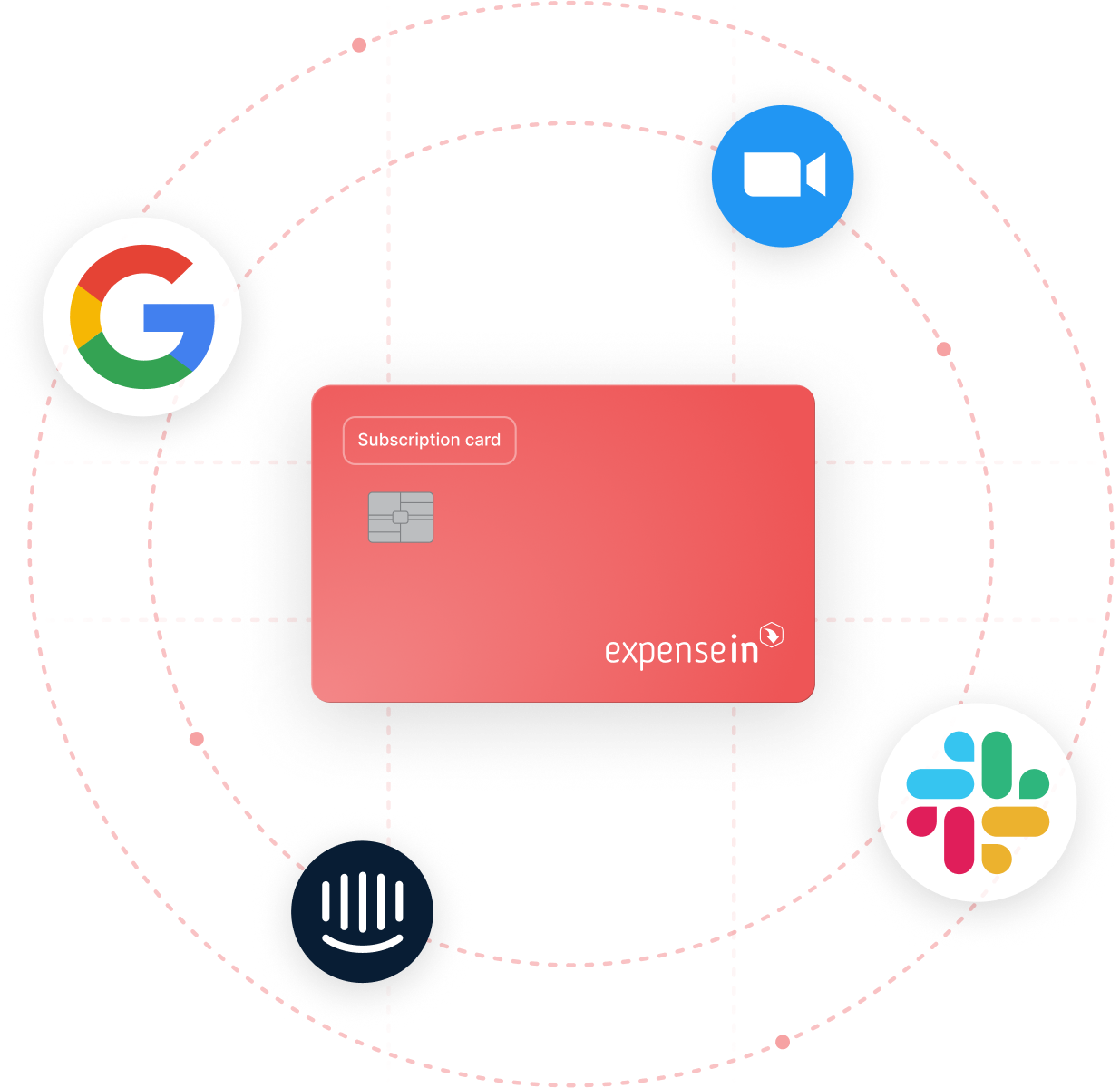

Recurring subscriptions

Assign one virtual card per tool for total clarity. Cancel in a click.

Project-based spending

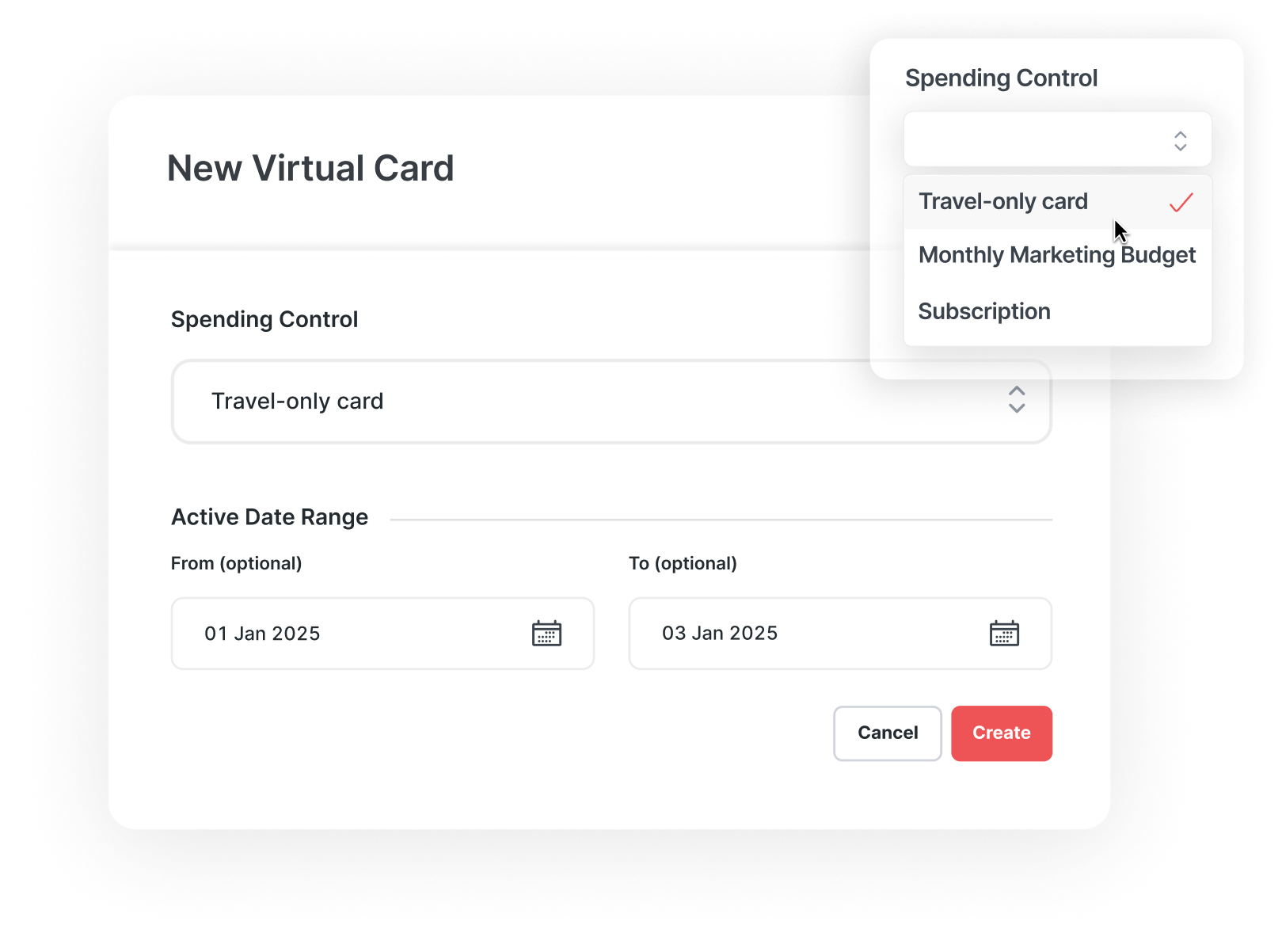

Create temporary cards for time-based projects. Auto-deactivate when done.

Powerful spend controls on every virtual card

Every virtual business card comes with robust, built-in controls:

Set daily or monthly card limits

Block certain merchant types, countries, or categories

Auto-expire cards after a set time

Assign by individual, team, or shared use

Reactivate dormant cards for new projects or tools

Take control of your recurring supplier spend

Use subscription cards for vendor and supplier spend – built for SaaS tools, retainers, and other recurring costs. Keep every payment visible, controlled, and separate from employee expenses.

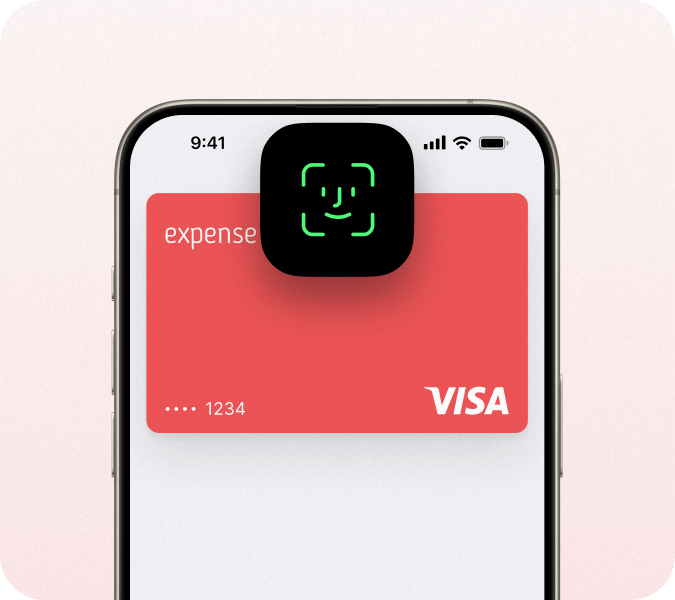

Use virtual cards for online & in-person spending

Add virtual expense cards to Apple Pay or Google Pay, and your team can pay in-store, on-site or anywhere contactless is accepted.

Works online, in-store and on the go

Add to Apple Pay and Google Pay in seconds

Ideal for travel and time-sensitive spend

Real-time visibility and notifications for finance

Security built into every card

Virtual cards avoid the risks of shared or physical cards. Every card is tied to an individual and stored securely in the app or mobile wallet.

No physical cards to lose, steal or skim

Unique card details that are never shared

Encrypted Apple Pay and Google Pay payments

Biometric authentication for every tap

How our virtual expense cards work

- 1

1. Make a purchase

Employees use virtual cards for approved purchases.

- 2

2. Capture in real time

Merchant data and draft expenses are created instantly.

- 3

3. Upload receipts

Cardholders are prompted to submit receipts in real time.

- 4

4. Approve & sync

Approvals flow through automatically, ready for export.

FAQs: Virtual cards for business expenses

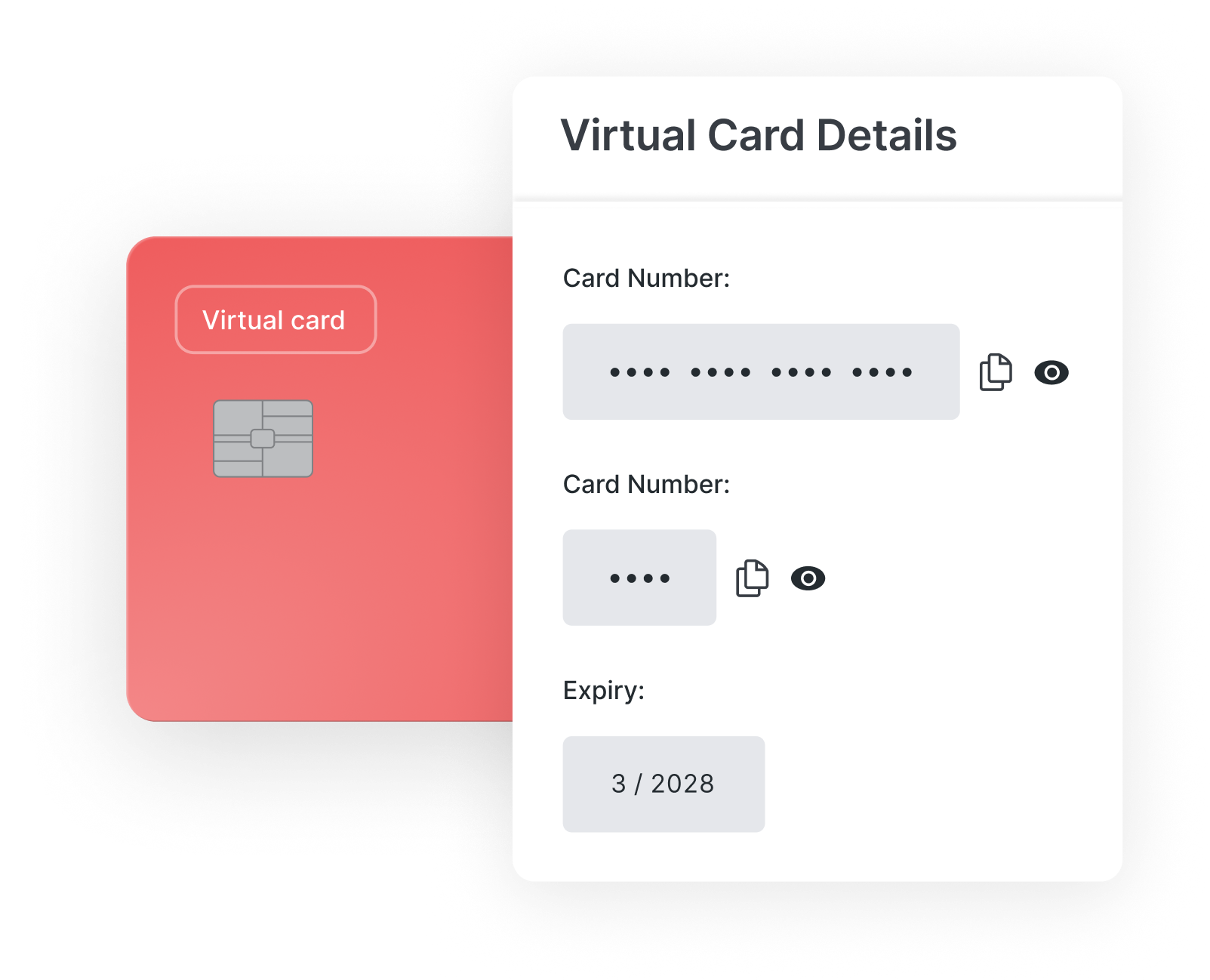

Virtual cards are digital payment cards that live in the ExpenseIn platform. Each card has its own card number, expiry date and CVV, and can be issued instantly for online or in-person spending through Apple Pay or Google Pay.

There’s no hard limit. You can create:

One card per team, project, or subscription

Multiple cards per person

Temporary cards for short-term initiatives

Every card is still assigned to an individual, so there’s always a clear owner – even when the spend supports a wider team or purpose.

It’s flexible, scalable, and fully under your control.

Absolutely. Use one virtual expense card per SaaS tool for:

Clear spend ownership

Simple cancellation and renewal control

Avoiding duplicate subscriptions

No more surprise charges on shared company cards.

Yes. You can create a virtual card specifically for:

Travel bookings and accommodation

One-off events, training days, or ad-hoc tools

Online grocery orders or office supplies

You can set start/end dates and auto-expire the card when it’s no longer needed.

You can:

Pause or cancel cards instantly

Review any active subscriptions tied to their cards

Maintain a full audit trail for every change

No need to chase plastic cards or untangle charges.

Yes. You can add ExpenseIn virtual cards to Apple Pay or Google Pay and use them for in-person, contactless payments as well as online purchases.

Effortless spend management for growing finance teams

Trusted by UK and Irish finance teams

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The biggest benefits since using ExpenseIn are its ease of use, configuration for back office and the mobile app.

Our employees are happier as they are getting paid quicker.

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The biggest benefits since using ExpenseIn are its ease of use, configuration for back office and the mobile app.

Our employees are happier as they are getting paid quicker.

See ExpenseIn virtual cards in action

Experience the ease of instant issuing, smarter controls, and integrated spend management – all in one platform.

More from ExpenseIn

Looking to streamline other aspects of your expense management process?